Investing In Robotics and Automation In 2022 - Britbots

Britbots has been investing in robotics, artificial intelligence and automation since 2017, with the core of our investment thesis centring around backing companies that pioneer productivity-boosting innovations: technologies that allow “more to be done with less”. From a societal perspective, productivity growth is the cornerstone of improving prosperity and living standards; and from an economic perspective, it makes it possible for companies to grow their margins and develop new revenue opportunities.

In our current world where the constraints arising from the limitations of labor, material resources and energy have become all too apparent, the urgency to find more productive approaches to existing activities has never been greater. From a company perspective we believe that investing in robotics and automation solutions will play a large part in alleviating these constraints. From an enterprise investment scheme perspective, we believe that growing demand at the company level for productivity solutions, will be a durable driver of returns for investments in robotics and automation technology providers.

Alleviating Global Productivity Challenges

Global productivity grew dramatically from the first Industrial Revolution until the post-War period, but since the 1970s growth in the Western World has slowed. In itself, given the importance of productivity to societies and corporate profits, this is concerning. But it is particularly so, given the increasing pressures on companies and economies posed by three related challenges:

- The Labor Challenge: Driving growth despite shrinking workforce availability;

- The Resources Challenge: Driving growth despite widespread material resource scarcity;

- The Energy Challenge: Driving growth whilst transitioning from unsustainable fossil fuels.

Britbots focuses on investing in entrepreneurs using r o botics, artificial intelligence and autonomous technologies to create compelling solutions to each of these three challenges. The companies that are being built, individually and collectively, offer the potential to return productivity growth to a higher level, establishing a new phase of prosperity for the years ahead.

1. Investing In Robotics and Automation: Meeting the labor challenge

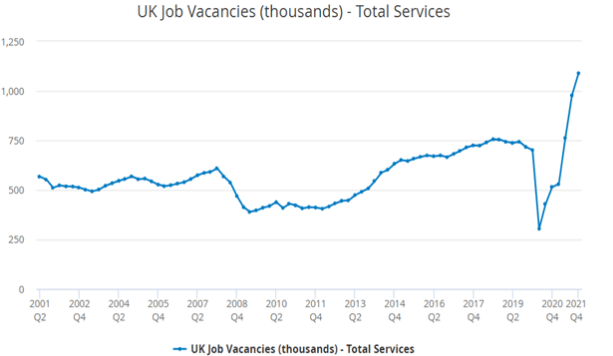

As job vacancies in the UK reach a record high of 1.2 million in November 2021 (ONS Data), an increase of 435,000 from its pre-Covid-19 level, the shortage of available workers has become apparent. The combination of longer-term trends such as the aging population with more near-term events such as the pandemic and Brexit have precipitated this chronic labor crunch.Clearly, this situation represents a significant opportunity for robotics and automation technology companies to provide solutions to close the workforce gap. In particular, capable machines which can operate autonomously for long periods are becoming attractive propositions for employers that are struggling to find staff. Anecdotally, levels of interest in robotic solutions in sectors such as agriculture, hospitality and elderly care, which previously had relied on plentiful supplies of labor and were hitherto unmotivated by automation, are now extremely high.

2. Investing In Robotics and Automation: Addressing material scarcity

Materials are another economic input for which companies are increasingly experiencing shortages. European consultancy, Inverto, published a study in December last year in which 73% of the business leaders surveyed remarked on the poorer availability of materials resulting from Covid-19, with 76% expecting a strong or moderate cost increase in raw material prices within the next 18 months. The problem, of course, does not just sit with primary materials but also extends along supply-chains leading to widespread availability pressures in areas such as microprocessors and renewable energy infrastructure.

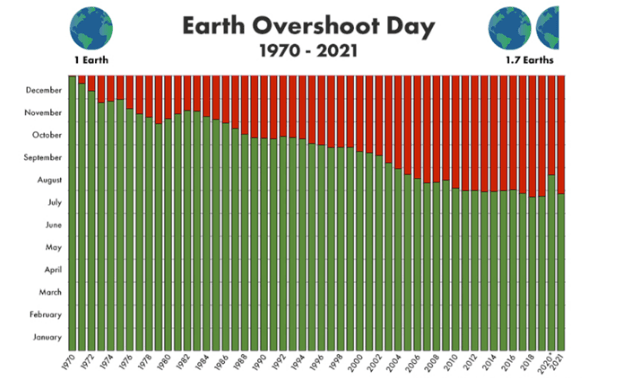

At the end of 2021, the world was consuming primary materials 70% faster than had been the case fifty years before, putting a great load on the planet’s ability to replenish its resources. The impact of the Pandemic on global trade has merely exacerbated businesses’ experience of these fundamental shortages.

Technologies which enable businesses, particularly those in resource-heavy sectors like industry, construction and agriculture, to make material inputs go further through improved efficiencies and waste reduction, will become increasingly sought-after as resource scarcity continues to intensify.

3. Investing In Robotics and Automation: Supporting the energy transition

As re-emphasised when world leaders met last November at COP26, the transition to Net Zero will require a fundamental re-engineering of almost every commonplace economic activity over the next thirty years.

Autonomous technologies will be essential in transitioning to the widespread electrification of industrial processes and vehicles. Smart systems have an important role to play in the eradication of fossil fuels as a power source. Additionally, they will both allow: industries to continuously measure and mitigate their emissions; and also underpin the new networks needed for the generation and transmission of clean energy.

It feels like a pivotal moment for investors in robotics, AI and automation companies. We remain optimistic that the sorts of businesses that Britbots supports will be able to deliver a positive impact to the productivity landscape over the years ahead and this will be the source of enduring returns for the fund.

About Britbots' Robotics, AI and Automation Fund

Britbots is a specialist SEIS fund and EIS fund investor. We invest in companies using artificial intelligence, robotics or other automation technologies to develop productivity gains and are typically the first external investor into a business.

If you are an entrepreneur looking for pre-seed or seed investment in the UK automation, artificial intelligence or robotics space please email alex@britbots.com