Sectorial Trends in Artificial Intelligence and Robotics Investing

- By Dominic Keen

- •

- 04 Apr, 2022

The Ark Big Ideas 2022 report was released last week – the yearly report from Cathy Wood’s ETFs backing publically list high-growth potential technology companies operating across AI, Robotic, Battery Technology, Blockchain and Gene sequencing.

Whilst Britbots restricts its investments to only two of these categories – robotics and ai based technologies – and at that only invests in in privately held companies based in the UK – the report is an interesting read for the bull cases for investing in automation technologies over the next decade

You can read the full report here but here are some extracts we thought particularly worthy of note:

- AI training costs appear to be declining at more

than twice the rate of Moore’s Law as performance is increasing significantly

[1].

- From 2015 to 2020, the cost to train as GPT-3 [2] mode dropped 65% each year from $875m to $4.6m [3].

- According to Arc research the cost may decline as much as another 4 orders of magnitude to $500 in 2030 [4].

- What does this mean? As the cost of model training decreases, the scope AI to be applied to more complex problems and a greater range of problems will increase disproportionately thereby supporting the increased adoption of ai based technologies.

- By 2030, artificial intelligence may be able to

boost the output of global knowledge workers by close to 10% annual rate, rising

from $41 trillion in expected human labour output (2021) to roughly $97

trillion in AI + human output (2030)

- What does this mean? The opportunity for enterprises to boost outputs relative to labour should lead to an increasing in AI software spending. Arc estimates this increasing from $1 trillion in 2021 to $14 trillion in 2030.

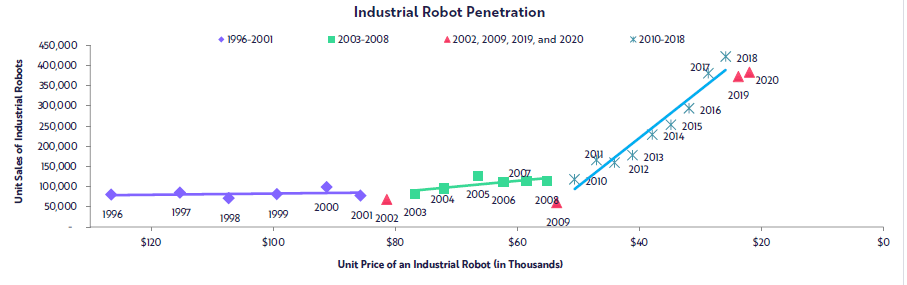

- Supply chain shocks and labour shortages should

accelerate the adoption of automation technologies. The adoption of industrial robotics

accelerated after the 2002 dot-com bust and again after the 2008-9 great

financial crises. It is likely that the supply chain bottle necks which

continue in a post-Covid world and the weakening of Sino/Western trade

relations will support the additional adoption of automation technologies. [4]

- What does this mean? Ark expects the increased adoption of robotic technologies to boost enterprise value of robotics companies by close to 100x by 2030, rising from an aggregate of $52 billion in 2022) to $5 trillion by 2030.

- Automation is consistent with job growth. Amazon deployed its first 200,000 robots over seven years and another 150,000 in just two years. During those nine years, Amazon's workforce grew nearly fifteen-fold. Despite the elimination of retail positions, automation can enable new products and services that otherwise would not exist, on balance increasing the demand for labour.

About Britbots: Britbots invests SEIS and EIS funds in to robotics, artificial intelligence and automation start ups based in the UK. We believe investing in automation is crucial to arrest 3 major crises companies and economies are experiencing: labour shortages, falling productivity and declining natural resources.

Footnotes:

1. Moore’s Law suggests that the number of transistors per silicon chip doubles every two years, thereby reducing the cost of compute by 50%

2. GPT 3 is a large language model developed by Open AI that uses deep learning to generate text, ranging from translation to poetry composition

3. At these costs, the cost to train a human brain of 240 trillion synapses would fall from $2.5 billion to $600,000 by 2030

4. Executive Summary World Robotics 2021 Industrial Robots.https://ifr.org/img/worldrobotics/Executive_Summary_WR_Industrial_Robots_2021.pdf.

Copyright 2022 - High Growth Robotics Limited, trading as "Britbots". Britbots' funds are managed by Sapphire Capital Partners LLP, a specialist

investment management firm authorised and regulated in the UK by the Financial Conduct Authority.

* Figures based on the most recent price-per-share of the companies in the British Robotics Seed Fund 2 as at 01/07/2022, inclusive of income tax benefits accrued.

Risk to Capital

Investing in start-ups and early-stage businesses involves risks, including illiquidity, lack of dividends, loss of investment and dilution. It should be done only as part of a diversified portfolio. Any investments are targeted exclusively at investors who understand the risks of investing in early-stage businesses and can make their own investment decisions. Any pitches for investment are not offers to the public. CAPITAL IS AT RISK.

Financial Services Compensation Scheme Disclaimer

Investments made in investee companies via funds managed by

Sapphire Capital Partners LLP

may be covered by the Financial Services Compensation Scheme (FSCS). For more details, please contact us or refer to their website: https://www.fscs.org.uk