Latest News

As the world begins to rebuild beyond the pandemic, the prospect that the forthcoming decade will be shaped by the growing sophistication of robotics and AI technologies is becoming more like and thesis driving robotics investing become more compelling. Minimum wages remain high in the Western world (despite the pressure on employment caused by the pandemic) and robotic platforms, now acting with greater levels of autonomy and precision, are increasingly making inroads into activities which have traditionally required high levels of manual labour. Despite this, the robotics investing model is typically less well understood than more standard playbooks for institutional technology investment such as Software-as-a-Service. Our next few articles aim to set to unpack this subject focussing on the following:

- A lack of clarity on whether robotics and automation start ups are pure hardware businesses;

-

The key characteristics of robotics and automation start up business models which underpin the growth of strong, scalable and defensible companies; and

-

The role of robotics and automation in boosting productivity and profitability, and why we believe robotics and automation investing will become a major investment theme over the coming decade.

(Mis) Understanding Hardware

There’s an elephant in the room when it comes to robotics and automation investing: the widely and often rightly held perception that “hardware is hard”.

Significant reservations are attached to investing into areas such as electronics or heavy machinery particularly due to:

1. Greater requirements for capital expenditure into tooling and production;

2. Less attractive unit profit margins;

3. More working capital tied up in inventory and work-in-progress materials;

4. Slower speeds to market because of longer development cycles; and

5. Friction in distributing products.

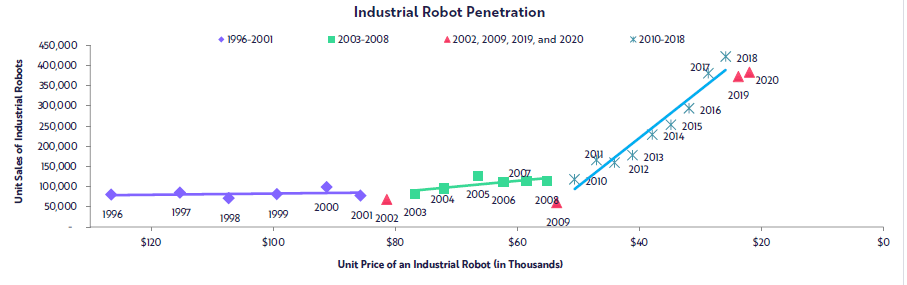

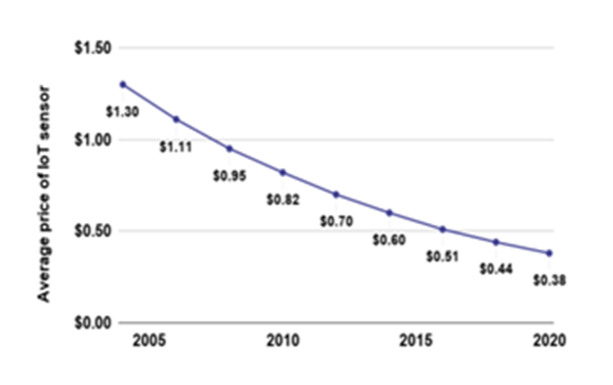

However, many of these concerns are now being circumvented by a new class of robotics start up whose products combine comparatively straight-forward and low cost hardware (for example, using off-the-shelf motors, actuators, cameras and sensors) with a more sophisticated, typically autonomous, software capability which sits behind this hardware.

We continue to focus on backing exceptional founding teams using robotics, artificial intelligence and other automation technologies to tackle the major productivity crises the world is facing namely:

- Labour Crisis: How to grow despite global shrinking labour growth?

- Productivity Crisis: How to grow despite falling global productivity growth?

- Environmental Crisis: How to grow whilst decreasing reliance on carbon and negative environmental impact?

- Resources Crisis: How to grow whilst reducing the pressure on already stretched natural resources?

As global consumption levels continue to rise, these pressures are likely to intensify. We believe that companies providing solutions to these problems will be able to generate durable returns and favourable valuations.

We have been delighted to welcome 9 exciting new companies to the Britbots’ portfolio of 2021.

Covering a broad range of industry verticals spanning agriculture, chemistry, alternative energy and transport, all our new companies are united by one constant: they are all developing radical, productivity maximising solutions to help their customers reduce costs and/or improve

performance.

- Altered Carbon – builds sensor technology which can identify and categorise scents as digital fingerprints

- Bladebug – builds micro robots to inspect and repair offshore wind turbines

- Calyo – builds sound vision technology allowing autonomous platforms to “see” in low visibility conditions

- CheMastery – builds automated solutions for bench chemistry

- Deep Meta – builds machine learning tools for steel and other metal producers to improve efficiency and reduce carbon emissions

- MetaLynx – builds tools for machine developers to more easily handle and categorise large data sets

- Muddy Machines – builds harvesting robotics for selective stemmed vegetables

- Rad Propulsion – builds electric, IOT connected propulsion devices for the marine industry

- Vizgard – builds computer vision tools to help safety and security providers identify and respond to threats

- Albion Tech - is building the world’s first Smart Battery Cell marrying individual Artificial Intelligence control within the Li-on battery cell assembly

Britbots is a specialist UK based pre-seed an investment fund, investing in 10 new pre-seed companies per year. We invest in companies using artificial intelligence, robotics or other automation technologies to develop productivity gains and are typically the first external investor into a business.

If you are an entrepreneur looking for pre-seed or seed investment in the automation, artificial intelligence or robotics space please email alex@britbots.com

Britbots has been investing in robotics, artificial intelligence and automation since 2017, with the core of our investment thesis centring around backing companies that pioneer productivity-boosting innovations: technologies that allow “more to be done with less”. From a societal perspective, productivity growth is the cornerstone of improving prosperity and living standards; and from an economic perspective, it makes it possible for companies to grow their margins and develop new revenue opportunities.

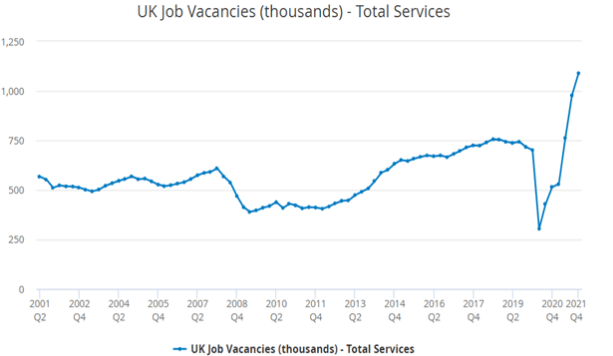

In our current world where the constraints arising from the limitations of labor, material resources and energy have become all too apparent, the urgency to find more productive approaches to existing activities has never been greater. From a company perspective we believe that investing in robotics and automation solutions will play a large part in alleviating these constraints. From an enterprise investment scheme perspective, we believe that growing demand at the company level for productivity solutions, will be a durable driver of returns for investments in robotics and automation technology providers.

Alleviating Global Productivity Challenges

Global productivity grew dramatically from the first Industrial Revolution until the post-War period, but since the 1970s growth in the Western World has slowed. In itself, given the importance of productivity to societies and corporate profits, this is concerning. But it is particularly so, given the increasing pressures on companies and economies posed by three related challenges:

- The Labor Challenge: Driving growth despite shrinking workforce availability;

- The Resources Challenge: Driving growth despite widespread material resource scarcity;

- The Energy Challenge: Driving growth whilst transitioning from unsustainable fossil fuels.

Britbots focuses on investing in entrepreneurs using r o botics, artificial intelligence and autonomous technologies to create compelling solutions to each of these three challenges. The companies that are being built, individually and collectively, offer the potential to return productivity growth to a higher level, establishing a new phase of prosperity for the years ahead.

Copyright 2021 - High Growth Robotics Limited, trading as "Britbots". Britbots' funds are managed by Sapphire Capital Partners LLP, a specialist investment management firm authorised and regulated in the UK by the Financial Conduct Authority

Risk to Capital

Investing in start-ups and early-stage businesses involves risks, including illiquidity, lack of dividends, loss of investment and dilution. It should be done only as part of a diversified portfolio. Any investments are targeted exclusively at investors who understand the risks of investing in early-stage businesses and can make their own investment decisions. Any pitches for investment are not offers to the public.

Financial Services Compensation Scheme Disclaimer

Investments made in investee companies via funds managed by Sapphire Capital Partners LLP are not covered by the Financial Services Compensation Scheme (FSCS). For more details, please contact us or refer to their website: https://www.fscs.org.uk

Copyright 2022 - High Growth Robotics Limited, trading as "Britbots". Britbots' funds are managed by Sapphire Capital Partners LLP, a specialist

investment management firm authorised and regulated in the UK by the Financial Conduct Authority.

* Figures based on the most recent price-per-share of the companies in the British Robotics Seed Fund 2 as at 01/07/2022, inclusive of income tax benefits accrued.

Risk to Capital

Investing in start-ups and early-stage businesses involves risks, including illiquidity, lack of dividends, loss of investment and dilution. It should be done only as part of a diversified portfolio. Any investments are targeted exclusively at investors who understand the risks of investing in early-stage businesses and can make their own investment decisions. Any pitches for investment are not offers to the public. CAPITAL IS AT RISK.

Financial Services Compensation Scheme Disclaimer

Investments made in investee companies via funds managed by

Sapphire Capital Partners LLP

may be covered by the Financial Services Compensation Scheme (FSCS). For more details, please contact us or refer to their website: https://www.fscs.org.uk