Better Understanding Robotics Investing

- By Dominic Keen

- •

- 15 Feb, 2022

As the world begins to rebuild beyond the pandemic, the prospect that the forthcoming decade will be shaped by the growing sophistication of robotics and AI technologies is becoming more like and thesis driving robotics investing become more compelling. Minimum wages remain high in the Western world (despite the pressure on employment caused by the pandemic) and robotic platforms, now acting with greater levels of autonomy and precision, are increasingly making inroads into activities which have traditionally required high levels of manual labour. Despite this, the robotics investing model is typically less well understood than more standard playbooks for institutional technology investment such as Software-as-a-Service. Our next few articles aim to set to unpack this subject focussing on the following:

- A lack of clarity on whether robotics and automation start ups are pure hardware businesses;

The key characteristics of robotics and automation start up business models which underpin the growth of strong, scalable and defensible companies; and

The role of robotics and automation in boosting productivity and profitability, and why we believe robotics and automation investing will become a major investment theme over the coming decade.

(Mis) Understanding Hardware

There’s an elephant in the room when it comes to robotics and automation investing: the widely and often rightly held perception that “hardware is hard”.

Significant reservations are attached to investing into areas such as electronics or heavy machinery particularly due to:

1. Greater requirements for capital expenditure into tooling and production;

2. Less attractive unit profit margins;

3. More working capital tied up in inventory and work-in-progress materials;

4. Slower speeds to market because of longer development cycles; and

5. Friction in distributing products.

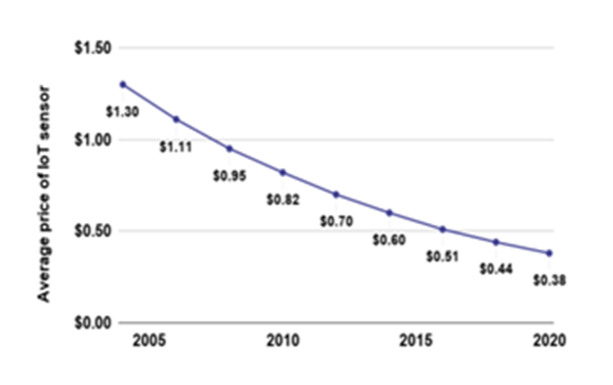

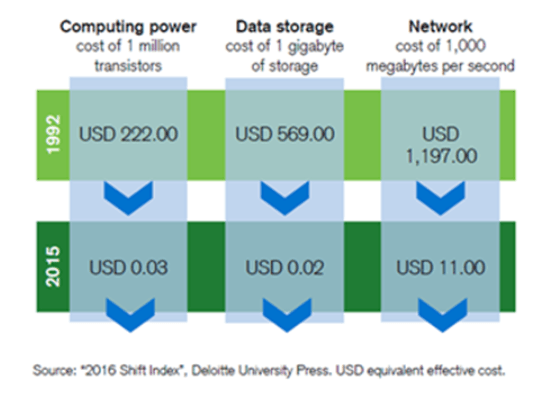

However, many of these concerns are now being circumvented by a new class of robotics start up whose products combine comparatively straight-forward and low cost hardware (for example, using off-the-shelf motors, actuators, cameras and sensors) with a more sophisticated, typically autonomous, software capability which sits behind this hardware.

In this “frugal-robotics” paradigm, bills-of-materials are kept low, product complexity is minimised and technologies such as 3D printing are used to ensure that external lead-time risks are eliminated. At the same time, these businesses can operate “Robotics-as-a-Service” models, with recurring monthly revenues from subscription fees and scope for additional “bolt-on” software upgrades, whilst maintaining defensibility by nurturing and then leveraging an organic, proprietary data set.

One way to relate to these businesses is as hardware-software hybrids with the hardware attributes providing access to a unique set of application areas with software driving the more attractive economic characteristics. Early versions of a product the software-hardware mix may be 50:50 however, following the incorporation of a number of downstream software bolt-on services, the mix could skew to 80:20 (hence substantially operating like a SaaS business).

Despite these characteristics, we still find that such robotics start ups tend to be valued much more modestly than pure software businesses, thereby creating plenty of scope for larger investment profits by the time they have a reached a maturity point when that they can be valued against their fundamental profitability. This is one reason why we feel the robotics investment niche represents such an attractive opportunity for wealth creation right now.

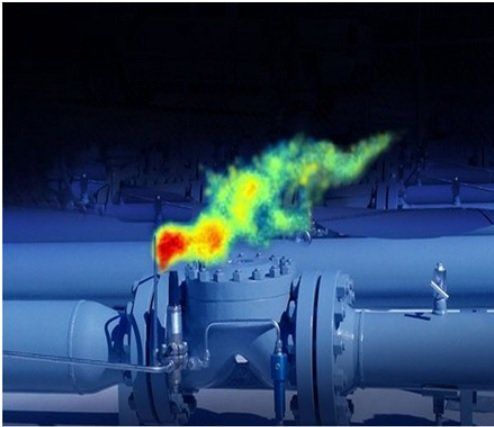

Case Study: Environmental Monitoring-as-a-Service

Existing Britbots portfolio company, QLM, is a good example of how comparatively low cost hardware can be used to provide the raw material – in this case proprietary gas flow data – processed by an autonomous software layer to provide fast, accurate and low-cost methane leak identification within oil and gas infrastructure.

Real World Problems

The last few decades have witnessed an enormous amount of new value by software businesses but the process of “software eating the world” has tended to limit solutions to servers and screens.

On the one hand, this has led to a high degree of competition and diminishing returns in software-only solutions. But more importantly, whilst it's true that software pure-plays have less friction to slow them down, ultimately they have one major drawback. Software by itself cannot conduct useful work in the real world. If deployed correctly, relatively simple electro-mechanical devices enabled by a raft of much more sophisticated software systems can perform tasks that open-up a previously unobtainable new frontier of economic value.

Construction, along with industries like agriculture, energy, manufacturing, logistics and security, is an example of an industry where innovation requires large amount of interaction with the physical world.

With a value chain delivering approximately $11 trillion of global value the ecosystem represents approximately 13 percent of global GDP (McKinsey Next Normal In Construction).

Nonetheless, there is a huge productivity problem: construction has seen a meagre productivity growth of 1 percent annually for the past two decades with the Economist estimating this costs the world economy $1.6 trillion per year

For obvious reasons, the most innovative solutions for this industry tend not to be digital only. Ultimately the value-add in construction comes from creating physical structures and installing the fixtures, fitting and decorations for buildings to be useful spaces for life and work.

Case Study: Paiting-as-a-Service

Existing RAIA portfolio company, Hausbots has developed a wall climbing robot to protect and maintain buildings and infrastructure, carrying out tasks such as painting, cleaning and undertaking visual inspections.

By employing Formula-1-style aerodynamics the Company has created a unique robotic platform that can climb vertical surfaces, apply paint and make inspections without the requirement for scaffolding. The solution can work least 300% faster than current methods, at 50% cost reduction in price and has received encouraging traction from some of the largest paint and painting-equipment companies in the world such as Bell, AkzoNobel and Henkel.

About Britbots

Britbots is a specialist SEIS / EIS venture capital fund investing in startups using artificial intelligence, robotics or other automation technologies to develop productivity gains. We are typically the first external investor into a business.

If you are an entrepreneur looking for pre-seed or seed investment in the UK automation, artificial intelligence or robotics space please email alex@britbots.com

Copyright 2022 - High Growth Robotics Limited, trading as "Britbots". Britbots' funds are managed by Sapphire Capital Partners LLP, a specialist

investment management firm authorised and regulated in the UK by the Financial Conduct Authority.

* Figures based on the most recent price-per-share of the companies in the British Robotics Seed Fund 2 as at 01/07/2022, inclusive of income tax benefits accrued.

Risk to Capital

Investing in start-ups and early-stage businesses involves risks, including illiquidity, lack of dividends, loss of investment and dilution. It should be done only as part of a diversified portfolio. Any investments are targeted exclusively at investors who understand the risks of investing in early-stage businesses and can make their own investment decisions. Any pitches for investment are not offers to the public. CAPITAL IS AT RISK.

Financial Services Compensation Scheme Disclaimer

Investments made in investee companies via funds managed by

Sapphire Capital Partners LLP

may be covered by the Financial Services Compensation Scheme (FSCS). For more details, please contact us or refer to their website: https://www.fscs.org.uk