Investing in EIS Funds, Consumer Duty

& Growth Strategies

In this article Dominic Keen, Managing Partner of Britbots, discusses which investors may benefit from investing under the Enterprise Investment Scheme (EIS) and the role that tax-advantaged investments play in helping financial advisors to comply with the recent Consumer Duty regulations.

Britbots operates fund offerings that build long-term wealth by specialising in artificial intelligence and robotics investments. For more information on Britbots' AI & Robotics Scale-Up EIS Fund, or anything of interest in this article, please get in with with Dominic directly at dominic@britbots.com.

As you know, the new Consumer Duty regulations place an onus on financial services firms to have a deep understanding of the wide variety of financial products available, on the basis that individual clients should receive individualised financial advice.

Indeed, even if you don't find your firm under direct scrutiny from the FCA as a result of Consumer Duty, when it comes time to sell-up or retire, it's worth considering whether shortcomings in the breadth of Consumer Duty compliance might negatively impact the valuation of your business by potential buyers.

So let us consider how investing in Enterprise Investment Scheme (EIS) funds may benefit certain investor groups, in particular high-income customers seeking some shelter from future income tax, capital gains tax and inheritance tax liabilities.

What is the Enterprise Investment Scheme?

The Enterprise Investment Scheme was introduced in 1994 as a governmental initiative to incentivise British investors to participate in early-stage, innovative UK-based businesses.

The scheme has been hugely successful, with over £30 billion invested in over 50,000 companies since its introduction. Last year (2022) over £2.3 billion was invested into EIS-qualifying companies. Investors who invest in EIS qualifying companies get to invest in high growth potential companies with protection offered by a series of generous tax advantages, reducing their downside risk exposure. These include:

1. 30% Income Tax Relief: 30% of the value of the investment can be set off against the investor’s income tax bill, which can be "carried-back" to be applied to the tax year before the investment is made.

2. No Capital Gains Tax: No CGT owed on any profit arising from the sale of EIS shares, provided they are held for three years before a sale.

3. No Inheritance Tax: No IHT is payable provided the EIS shares have been held for at least two years.

4. Loss Relief: If things don’t go to plan, any loss, less the Income Tax relief received, can be offset against the investors income tax bill. So, in total a higher-rate taxpayer could effectively reduce a total loss of £1 to £38.50.

For more of Britbots' updates and insights, just register here.

What are EIS funds?

EIS funds, such as

Britbots’ AI & Robotics EIS Scale-Up Fund, are speciality investment funds investing solely in EIS-qualifying companies. An investor in an EIS fund benefits from the tax advantages via a portfolio of qualifying companies, thereby spreading the risk across a basket of, typically, 8-12 companies. The portfolio companies are sourced by a fund manager, who will undertake due-diligence on the investment, meaning that the individual investor can remain passive in the process. To take advantage of EIS, and therefore EIS funds, an investor must be a UK taxpayer.

Consumer Duty: Which customers might EIS funds be most suitable for?

There are three core groups of investor who may particularly benefit from investing in EIS funds.

1. Investors with high incomes, looking to reduce their income tax bills

EIS is a great compliment to ISA and Pension plans, as a way for higher-rate taxpayers to store their capital in a tax efficient manner.

Compared against ISAs and Pensions, the total sterling amount which an investor can offset against their income tax bill each year under EIS is significantly higher. If investing in EIS Knowledge Intensive companies (as Britbots does), it is possible for an EIS investor to offset as much as £600,000 per year against their income tax bill (this being 30% of a £2,000,000 EIS Knowledge Intensive investment). This limit compares favourably against the £20,000 ISA annual ceiling and the £40,000 Pension annual maximum (tapered for those earning over £260,000).

2. Investors looking for tax efficient means of transferring inter-generational wealth

Unless given away over seven years before death, assets passed intergenerationally will attract inheritance tax up to 40%. IHT is payable on ISAs; and passing pensions through an estate requires complex and expensive structures.

By contrast, EIS investments can be passed across generations tax-free, provided they have been held for at least two years by the original investor.

3. Investors looking to access high returns from technology investing whilst also seeking tight management of the associated risks

Whilst a range of businesses can be EIS-eligible, many businesses funded by EIS funds, such as Britbots’ AI & Robotics EIS Scale Up Fund, are in the technology sector. EIS funds can be a good way for investors to access companies developing transformational technologies, such as generative Artificial Intelligence (AI). Often such companies are only accessible via venture capital funds (which are usually accessible only to institutional investors or ultra-wealthy individuals who can fund large minimum investment amounts).

By contrast, EIS funds allow individual investors access to the early-stage technology category, with lower investment amounts (as little as £10,000) spread over a portfolio of companies.

Further incentivisation is provided in the form of capital gains tax relief on an exit (provided the relevant shares have been held for over three years) and downside production which totals up to 61.5% of the capital invested (for the higher rate tax payer) should an investment fail.

Whilst investing in fast-growing start-ups has the potential to be a source of higher money-on-money returns than investing in more established companies, investment in this category is inherently more risky and illiquid than other investments, so clients should be made aware that their funds (not including the income tax rebates) will be tied up until a liquidity event occurs. Typically this is likely to be more than five years following an investment.

Britbots' AI & Robotics EIS Scale Up Fund

Britbots is a long standing EIS investor having invested in over 40 early stage UK companies in robotics, AI and automation.

Our investment thesis centres on investing in productivity-enhancing technologies which allow scarce resources to last longer. As global consumption levels continue to rise, our investments address the core areas of global scarcity: shortages of skilled labour, the transition away from fossil fuels, supply chain inefficiencies and depleting natural resources.

Here are some of the reasons why investors have chosen to invest with us:

1. Access to strong fund performance: £100 invested in 2018 is now worth £387*

2. Investing at the frontier of automation technology: as an asset class which invests in frontier technologies, venture capital investing is normally restricted to large institutional investors writing minimum sizes checks of several hundreds of thousands pounds. Our funds allow investor to access with as class with an investment as little as £10,000.

3. Visibility of the fund composition: investors in venture capital funds will not normally see the composition of those funds at the time they invest. The Britbots’ AI & Robotics EIS Scale Up Fund is different. Investors see the companies the fund is investing in up-front. This means advisors can have total clarity on what their client will be invested in and gives them the best opportunity to match their clients' needs and objectives with the investee companies.

4. Addressing core impact issues: shortfalls in economic and environmental productivity are some the principle issues of our time.

5. Downside risk mitigation via EIS:

venture capital is a high risk category, however, we ensure our investments are in EIS-qualifying companies meaning investors can benefit from the tax advantages described earlier in this article.

Current Companies in the Fund

CheMastery

What: CheMastery uses robotics to automate the currently slow, manual processes associated with in formulating chemicals in laboratories.

Why we are excited:

An estimated £650 billion of small batch speciality chemicals are manufactured globally each year yet chemistry work is currently highly manual, inaccurate and time consuming. CheMastery are building natural language processing software to standardise and enhance chemical recipes and a robot to execute these recipes automatically. The Company has signed pilots with four of the most significant UK chemical manufacturers: Pfizer, Key Organics, Cats Eyes and Charnwood Molecular.

RAD Propulsion

What: RAD technology are building electrical engines for the marine industry as it transitions away from fossil fuel power.

Why we are excited: Globally, approximately £10 billion is spent on marine diesel propulsion devices each year. Despite the industry’s inevitable switch to electrical alternatives, current solutions are not up to scratch: their hardware is not fit for commercial applications, and their software lacks real-time monitoring and data collection. The Company’s founders, who previously exited a marine automation business for over $95 million, are correcting this by creating a fully integrated “Tesla” experience for boats. RAD propulsion is already selling its solution to leading boat-builders such a RS Boats and Hydrex.

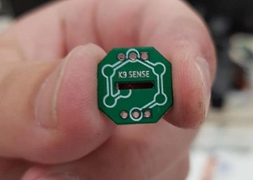

Altered Carbon

What: Altered Carbon is digitising the sense of smell, effectively shrinking the capabilities of a powerful mass-spectrometer to the size of a microchip, allowing complex scent profiles to be detected quickly, conveniently and cheaply.

Why we are excited: Airborne chemical scents provide advance warning for costly problems, such as food spoiling, disease or fire, well in advance of visual detection. Altered Carbon have built a patented sensor akin to a sniffer dog’s nose which can detect these chemical scents quickly and cheaply. The company’s beachhead market is food waste prevention, where an estimated £1 trillion can be saved each year by predicting spoilage. Altered Carbon’s products are currently being trialled by Philtrum Group, Fragro, Avara and B-Hive.

Earswitch

What: Earswitch have built a new form of computer interface, allowing electronic devices to be controlledby muscle movements in a person’s inner ear, via earbuds.

Why we are excited: Computers have been controlled by mice or track pads for the last 50 years. Earswitch’s patented technology will give the additional capability for humans to control computers by head and ear movements. At a smaller, medical level, this has fantastic implications for sufferers of Motor Neuron Disease, but at a larger scale, the Company’s technology provides enormous additional capability in gaming and spatial computing, by way of the 970 million earbud headphone units sold each year.

Fish Friendly Hydro

What: Fish Friendly Hydropower builds floating hydro-turbines which are easy to install and avoid the need for permits from the Environment Agency.

Why we are excited: There are over a million weirs and mills in Europe which contain power that could be used to generate the clean electricity needed to transition from fossil fuels, but are not due to regulatory restrictions. Fish Friendly solves this problem with their environmentally-friendly solution and has a rapid customer payback period.

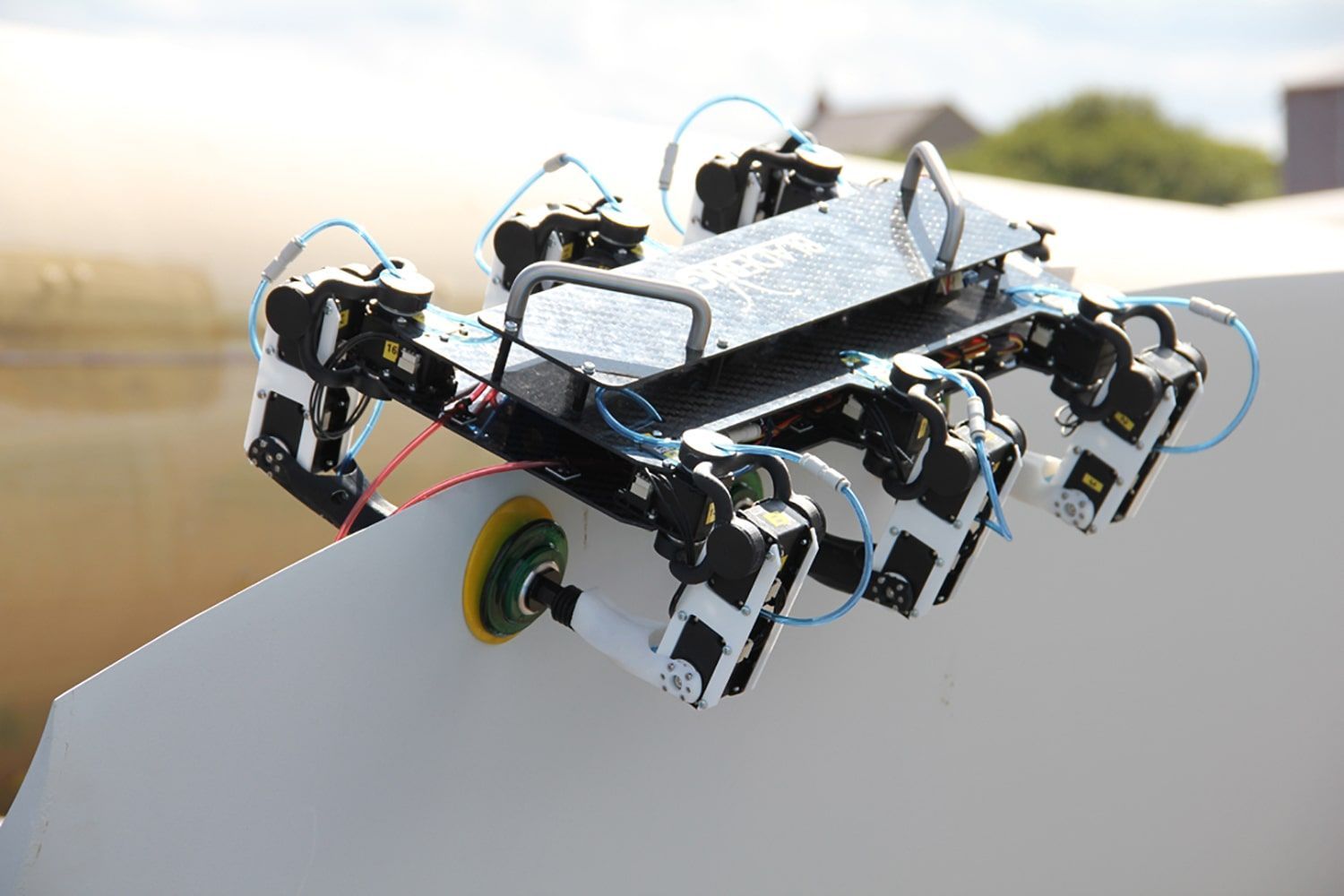

BladeBUG

What: BladeBUG builds robots to automate the inspection and maintenance of wind turbines, increasing turbine uptime and reducing the risk to workers.

Why we are excited: As the offshore wind industry is grows, so does the need to provide maintenance for turbines, not least because wind turbine downtime can cost as much as £30,000 per day in lost revenue. The wind turbine inspection market alone is forecast to be £7.5 billion by 2025, and yet a shortfall of 500,000 workers capable of carrying out these tasks is also predicted. BladeBUG’s highly mobile solution bridges this gap. The company is currently working with major wind power operators WindPower Lab, Mistras, and Force Technology to scale the deployment of its solution.

Bot-Hive

What: Bot-Hive is a provider of flexible automation systems, allowing customers to adopt these technologies in an easy and cost effective manner.

Why we are excited: Adopting automotive systems can radically improve the productivity and therefore profitability of a business, however the process of designing and commissioning automation systems is often complicated and expensive, particularly for production systems than need to be frequently re-configured. Bot-Hive is reducing this complexity by building the knowledge and APIs needed to link these complex systems together. Their systems are currently being trialled by Games Workshop and the Hut Group.

Marble

What: Marble builds long-range drones for use in the maritime surveillance missions.

Why we are excited: As a result of smuggling, piracy and illegal fishing, approximately £3.2 billion is spent each year on maritime surveillance. This is typically performed by boats which have limited range, or drone equipment which is often cost prohibitive. By contrast, Marble has innovated a low cost, electric solution which now demonstrates the range and speed of drones 4-times bigger and costing 200-times more. The Company has ongoing trials in the Turks & Caicos Islands and is one of the few drone companies to have been certified for Beyond Line of Sight flight in the UK.

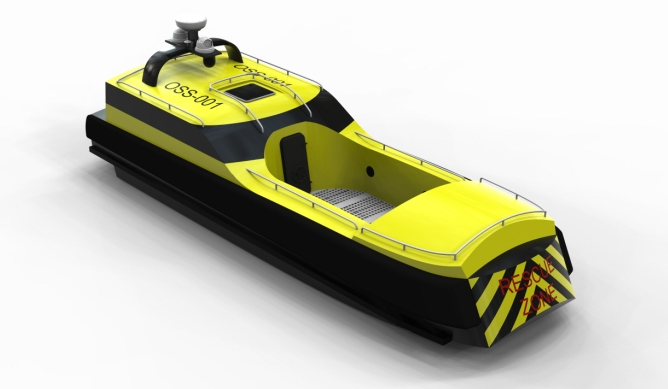

Zelim

What: Zelim are automating the process of search-and-rescue to save lives at sea.

Why we are excited: Offshore rescue is still carried out relatively primitively: man-over-board cases are spotted at sea by eye and typically rescued by ropes. Zelim have created a computer vision system to automatically locate casualties at sea; a retrofittable man-over-board conveyor belt to automate rescue; and is developing a fully autonomous rescue craft. The company’s solution targets the 80,000 ships legally required to carry a fast rescue craft as well as operators in the wind-farm sector, some of which have provided the Company with letters of intent to buy.

Dubbl

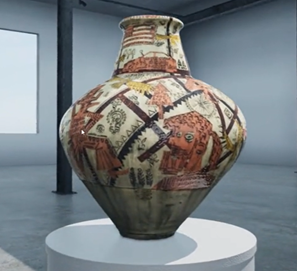

What: Dubbl has built ultra-realistic 3D scanning technology, allowing customers to transform real-world objects into highly detailed digital doubles.

Why we are excited: Dubbl has created the gold standard for 3D scanning which has been validated in the high-end art market by galleries such as the White Cube, David Zwirner and Victoria Miro with artists like Grayson Perry. The company is in the initial stages of a new strategic partnership with one of the world's largest art storage and logistics services.

For more of Britbots' updates and insights, just register here.